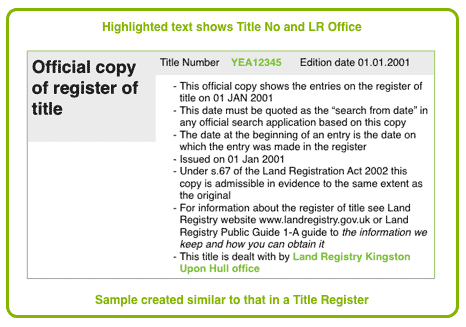

Title Number

A unique Title Number is allocated by the Land Registry to each and every property that is registered. This identifies the property and distinguishes it from other properties having similar addresses.

If you have a property's Title Number this is all that is required to identify it and to obtain copies of the Title Register or any other registered document.

Communications to the Land Registry should always contain the Title Number in the reference for ease of identification.

The Title Number is particularly useful in identifying properties that do not have full postal addresses, e.g. a field or woodland. For this reason it is always prudent to keep a note of the Title Number in the event that you mislay any of your registered documents.

Title Numbers begin with 2 or 3 letters following by a number. The letters identify the county in which the property is situate, e.g. MS123456 denotes a property in Merseyside; YEA denotes a property in the East Riding of Yorkshire.

The Title Register, Title Plan and registered Deeds all contain the Title Number at the top of the document, in large bold type.

Land Registry Offices

HM Land Registry has many office buildings covering the whole of England and Wales. Each area is allocated a specific Land Registry office, and the name of that office is shown at the top of each Title Register, e.g properties in Merseyside are dealt with by the Birkenhead Land Registry.

If you are dealing direct with HM Land Registry all communications with them pertinent to a particular property should be sent to that Land Registry office.

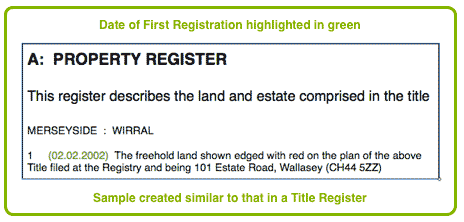

Date the Property was First Registered

At the beginning of the A section there is a date in brackets. This is the date the property first became registered. This date is often shortly after the date the property was built, so persons looking to find the age of the property can often use this date as a guide. This date is often required for insurance purposes.

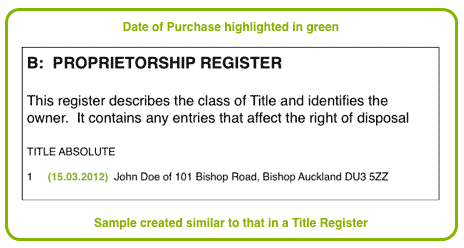

Date of Purchase by Current Owner

At the beginning of the B section there is another date in brackets, alongside the name of the owner. This is the date that the present owner was registered as such, and follows closely after the date of purchase.

This date is of particular relevance when applying for Prior Copies of the Register (History Search) as the date for a Prior Copy Search must be earlier than this date.

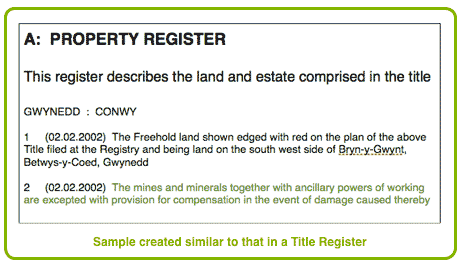

Property Address

The A section of the Register describes the property. Paragraph 1 will state the postal address, if it has one, and describe it as consisting of the property edged in red on the Title Plan.

Any land removed from the Title will also be mentioned here, and will be referred to as land edged in green on the Title Plan. Any such land will be allocated a separate Title Number which will also be shown on the Title Plan. Land may be removed from a Title where part of it is sold to someone else, e.g. following a boundary dispute or where a builder divides his land into smaller parcels. A separate search can be made for the land removed, if required, using the Title Number provided.

Where the property does not have a full postal address it will often be described as, e.g. land edged with red on the plan of the above Title and being land on the east side of Grosvenor Street, Tanner, Worcestershire". Searching for land without a full postal address has to be made by plan.

The property is further described by reference to its tenure, i.e. it will be described as freehold, leasehold or commonhold land.

Exclusions from the Title

The rights to mines and minerals to the land, if there are any, are likely to be excluded from ownership in favour of the Crown. The provision for exception is found in the A section of the Register.

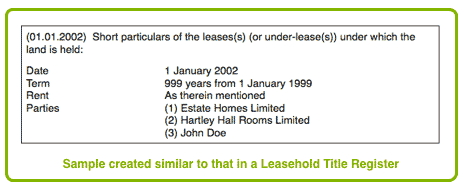

Leasehold Titles and the Lease

The Leasehold Title Register is set out similarly to the Freehold Title Register. In the A section of the register the property description refers to the property as leasehold land. One significant difference between freehold and leasehold titles, however, is that the leasehold title, in the A section, provides short particulars of the lease from which the title is derived.

This will include the date of registration of the original lease, the date of registration of the purchased leasehold title to the present owner, the length of the lease, any rent applicable and the names of the original parties to the lease, i.e. the original freeholder, the original tenant and any management company.

The short particulars of the lease will be followed by a statement that the landlord's title (freehold or superior leasehold title) is also registered, where it is registered.

Leases will usually contain numerous restrictive covenants, and these are generally detailed in a schedule at the end of the C section of the register.

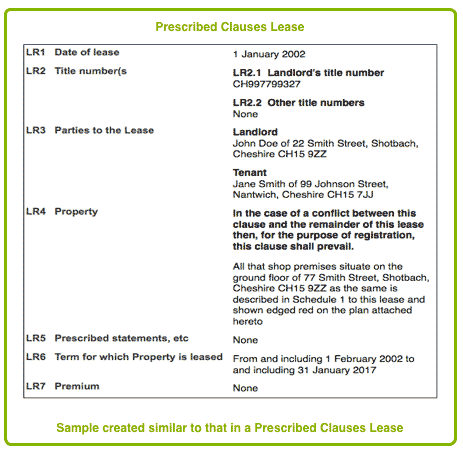

The Prescribed Clauses

- LR1 Date of Lease

- LR2 Title Numbers - the leasor's title number and any others

- LR3 The Parties of the Lease

- LR4 The Property

- LR5 Certain Statements, e.g. that the lease is in favour of a charity or granted under the Leasehold Reform Act 1967

- LR6 The Term of the Lease (It's length)

- LR7 The Premium paid for the Lease (i.e. purchase price)

- LR8 Prohibitions or Restrictions on disposing of the Lease

- LR9 Rights of Acquisition, e.g. right to renew, right to surrender, landlord's right to acquire the Lease.

- LR10 Restrictive Covenants

- LR11 Easments

- LR12 Rentcharge burdening the property

- LR13 Any application to enter a Restriction in the Title Register

- LR14 Declaration of Trust (where the tenant is not sole proprietor)

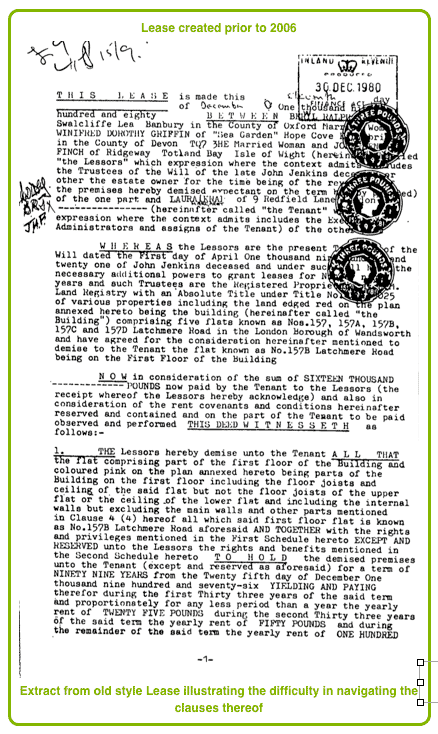

The format of the Lease will differ according to the date upon which it was created. Leases created since the coming into effect of the Land Registration (Amendment) (No 2) Rules 2005 must contain Prescribed Clauses, which are set out in the Statutory Instrument creating them. The Rules came into effect on 18 June 2006.

There are 14 Prescribed Clauses, which are listed in Schedule 1A of the Rules.

The effect of the Prescribed Clauses is to simplify the reading of the lease and navigation of the clauses and data it contains.

Leases prior to this date are more difficult to read and understand.

Rent Charges, Chief Rents and Ground Rents

Rent Charges are also known as ground rents. In some parts of the country, e.g. Manchester, ground rents are called chief rents. The idea behind all rent charges is that once a property is sold an annual charge is made to the owner of the rent charge, albeit a small one. Rent charges are presently being phased out and will be extinguished altogether in 2037.

To discover the identity of the rent charge holder one merely needs to look at the freehold title register, or any superior leasehold title (from which the current lease (underlease) is derived).

Property Ownership

One of the most useful reasons for a person to obtain a copy of the Title Register is to check the property description and the ownership details, either to confirm that they themselves own the property, or else to confirm the identity and current address of the owner, if someone else.

The B section of the Title Register deals with ownership. It states the name and address of the current owner. The names of previous owners are not shown, although one can obtain an historical copy of the Register, back to 1993 which will show the owner at that particular date.

The Land Registry allow up to 3 different contact addresses to be shown in the Register for each owner, so if there are 2 owners it is possible to have 6 different contact addresses recorded. Such addresses can include an email address and an address Abroad. The idea of this is to reduce the incidence of fraud, as the Land Registry will contact the owner at each of the addresses whenever an application is made to change the register, as would happen in the event of a new purchase or mortgage.

For this reason it is important for an owner to keep his/her address details up to date.

It is not necessary to obtain the owner's consent to obtain a copy of their Title documents, and neither are they informed of the purchase at any time.

Where a person desires to obtain the owner's address, e.g. a tenant wishing to contact his landlord, but the owner has not kept his address details up to date, the Title Register will only display his last notified address, which is often the address of the property. Where this occurs it may be possible to send a stamped addressed envelope to the mortgagee (listed in the C section of the Register) and ask the mortgagee to forward a letter to the owner. The mortgagee will usually know the owner's current address.

Ownership details are often required in connection with court proceedings, to trace debtors, carry out status reports on debtors, to provide evidence of ownership to civil authorities (passport office, inland revenue, etc), for insurance purposes and so on.

Many infrastructure, development and building companies need to know the ownership details of properties prior to activities such as laying cables, pipelines, purchasing land for development and so on.

Where property does not have a full postal address it is more difficult to obtain a copy of the Title documents. However, we do offer a specialised search for this, namely our Title Register search for properties with no postal address.

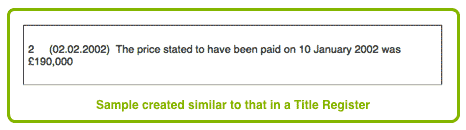

Purchase Price

As a general rule the purchase price is shown in the Title Register for properties purchased after 1 April 2000. A note of the price appears in the B section of the Register, together with the date of registration of the purchase.

The actual price may not be shown. If the price is uncertain then the value stated by the purchaser will be shown instead. The purchase price would normally be shown where the purchaser paid stamp duty, where it is stated on the Transfer Deed or other document (e.g. the contract for sale) or where there is a probate valuation.

If the price was paid in a foreign currency and that is shown on the Transfer deed then that is the price that will be shown in the Title Register.

Where no payment was made, e.g. the property was transferred to the current owner as a gift, then the value will be shown instead. The value may be shown to be an amount between two price ranges, or shown as over a certain amount. If the value cannot be accurately gauged then it may be omitted altogether as it may otherwise be misleading.

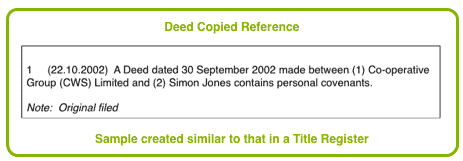

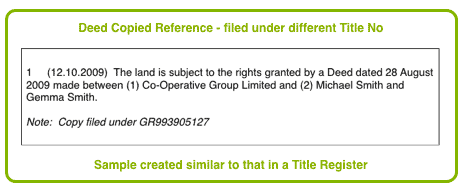

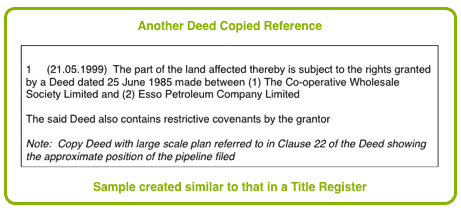

Referenced Deeds

Notwithstanding that all properties sold or mortgaged are now subject to compulsory land registration (and therefore Land Registry approved documents must be used for the purchase deed (Form TR1 for example)), the old deeds and documents left over from the pre-registration system of conveyancing remain with us and still have a vital role to play in many aspects of property ownership.

Post-registration conveyancing is governed by the Land Registration Act 2002 and requires most deeds to be in a form approved by the Land Registration Rules 2003. The purchase deed is now called a Transfer. A simple transfer of the whole of a title is in Form TR1; a transfer of part only of the title, in form TP1.

Some parcels of land are subject to many covenants, easements, restrictions, agreements, etc and the modern Transfer Deed or old Conveyance Deed may contain many pages containing voluminous details of such. There may also be other deeds recording agreements entered into between the parties, again containing much detail. As a general rule the Land Registry will try to produce a Title Register (the main document proving ownership under Land Registration) that contains all this detail. Where it is too much, however, a reference will be made to the deed containing it and the deed will be retained by the Land Registry so that it can be provided to people requiring further detail, e.g. on the sale of a property where there is a dispute about the boundaries of the property or where there are issues relating to rights of way, rights of access, rights of light, etc.

Deeds may be retained by the Land Registry either as digital (scanned) copies or as paper copies. Where a scanned copy of the Deed is retained the Land Register will make a note at the end of the paragraph referring to the Deed that a copy has been filed.

You can order a Deed by using the Deeds Search form.

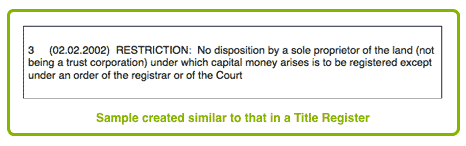

Restrictions

A Restriction is an entry made in the register that denotes a fettering of the owner's title, as for example, where the property is owned as a tenancy in common, rather than a joint tenancy. This would mean that a sole owner could not sell the property. The Restriction prevents or regulates the owner from making a disposition such as a sale or mortgage.

Another example is where the owner cannot sell or mortgage the land without the consent of his mortgagee.

Restrictions are found in the B section of the register.

Tenancies in Common and Joint Tenancies

Joint Tenancy

A Joint Tenancy, properly known as a Beneficial Joint Tenancy, is one of the two main ways that a property can be owned by two or more people.

When a property is owned in this way each joint owner holds 100% of the property, i.e. there are no divided shares as each person owns the whole. This means that if one or more of the joint tenants die the survivor already owns the property, without the need for it to be transferred or conveyed to him. Thus there is no disposition and therefore no taxable transaction.

The terms "Joint Tenancy" and "Tenancy in Common" do not refer to a lease or tenancy of a property, but are merely the legal definition of how a property is owned by two or more people. Joint Tenancies and Tenancies in Common apply whether the property is leasehold or freehold.

In most instances two or more owners of property hold it as joint tenants. However, a huge disadvantage of owning it in this way is that the respective owners cannot leave their share of the property in a Will, as they do not own a share. Upon the death of a joint owner their ownership of the property automatically devolves on the surviving owners (right of survivorship) and any provision in the deceased's Will is of no effect.

Right of Survivorship is a powerful legal right in so far as it takes priority over all other claims when distributing the deceased's estate (assets). There will be no need to obtain Probate and the deceased's unsecured creditors, beneficiaries and family will have no prior claim on it. Husbands and wives often own the property as Joint Tenants so that inheritance tax will not fall due upon the death of the first one of them, the effect of which might otherwise necessitate the sale of the property to pay the tax and thereby dispossess the survivor.

Production of an official copy of the Title Register showing the owners as joint tenants will dispel any attempt in court to defeat the right of survivorship.

Tenancy in Common

A Tenancy in Common is the other way that two or more people can own property. Each owner has a specified share in the property, or if no share is specified, they each have an equal share. This type of ownership is more prevalent in Ireland than in England and Wales but as marriages become less common and civil partnerships more common, more and more joint owners are evolving to ownership as a Tenancy in Common.

The owners of the property decide what share of the property they own, whether it is 50% each for two owners, 40% and 60% and so on. Often it depends on the size of the respective contributions towards the purchase price.

Unlike Joint Tenants, Tenants in Common can leave their share in a Will, although this may give rise to inheritance tax. Following the death of one of the Tenants in Common his share will devolve according to the terms of his Will, or if there is no Will, then the rules of intestacy.

The Title Register does not state whether the property is owned as a joint tenancy or a tenancy in common. However, a tenancy in common is usually recorded on the register as a Restriction using the following wording:

RESTRICTION: No disposition by a sole proprietor of the registered estate (except a trust corporation) under which capital money arises is to be registered unless authorised by an order of the Registrar or the court.

A joint tenancy can be converted to a tenancy in common by service of a notice of severance and the registration of the above Restriction at the Land Registry.

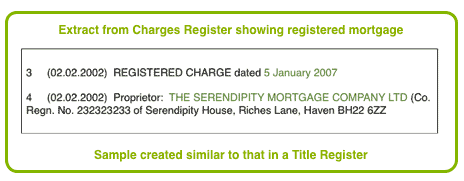

Mortgages and Charges

Although there is a technical difference between a mortgage and a charge for all intents and purposes, and for the purpose of this book, they are the same thing.

Mortgages and Charges are noted to in the C section of the register. The date of registration is provided in brackets, followed by a description of the mortgage or charge. The line following provides the name of the proprietor of the mortgage (the mortgagee) and their address for service.

If there is more than one mortgage they are entered in order of priority.

Where the mortgagee is under an obligation to make further advances this is also recorded, together with a statement that any such further advances will take priority over any further mortgages or charges registered after that mortgagee's earlier advance, so far as is allowed by section 49(3) Land Registration Act 2002.

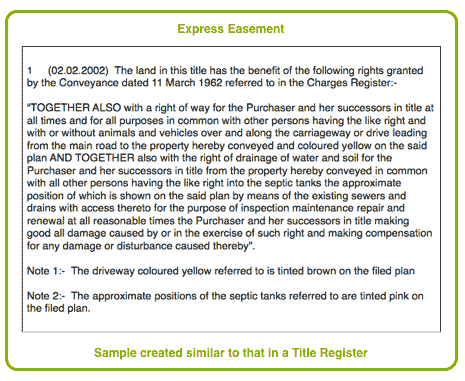

Easements

Easements are private rights, such as a right of way, that permit you to use another person's property without owning it. There are four main categories of easements (or rights), over an adjoining parcel of land. These are rights of way, rights of light and air, rights of support and rights relating to artificial waterways.

All easements have similar properties in that:

- There must be two adjoining properties; one of which has the benefit of the right, known as the dominant tenement (this is a positive easement), and one which has the burden of the right, known as the servient tenement (this is a negative easement).

- The owners of the two properties must be different from each other

- The right must be recorded by deed and in the case of registered land, should be recorded in the Title Register for each property affected.

Easements may arise in 6 different ways:

1 Express Easements

An express easement is expressed to be so by deed and in the case of registered land is referred to in the A Section of the Title Register for the dominant tenement and in the C Section of the Title Register for the servient tenement.

An example of an express easement is where, on the sale of part of a parcel of land the vendor agrees that the purchaser may have a right of way along his drive. This will be recorded in the transfer deed and an entry will by made by the Land Registry in the A section of the purchaser's new Title Register and in the C section of the vendor's Title Register.

2 Implied Easements

Implied easements are not created by deed but are implied by the law, the courts looking at what the original parties intended and how the property is being used.

3 Easements of Necessity

An easement of necessity only comes into existence once the court makes an order for the same. Usually the easement is required because a property owner cannot obtain entrance to his land without crossing an adjacent parcel of land, i.e. his property is landlocked. In such circumstances application must be made to the court for the easement on the grounds that it is necessary for the enjoyment of the property. A similar right might exist where a gable wall requires repair but cannot be reached save by accessing an adjoining property.

The court will decide whether to grant the easement by deducing the intention of the original parties and whether the damage or inconvenience would be greater for the dominant or the servient tenement and make an order accordingly.

Once the need for an easement of necessity ceases to exist, e.g. because an access path is made or because a legal easement is created by deed, then the easement of necessity automatically ceases to exist.

4 Easements by Prior Use

It is possible to create an easement simply by having used the property in a similar way before. The court will assume that the parties intended to create it but forgot to declare the easement in the deeds.

In order for such an easement to exist it must be shown that:

- Both properties were once in the joint ownership of a person or persons

- The properties were divided

- That the use for which the easement is required existed before the properties were divided

- That the easement was patently obvious, i.e. is discernible by inspection

- The easement is reasonably necessary and will benefit the dominant tenement.

5 Easements by Prescription

Easements by prescription are similar to claims for adverse possession (or squatter's claims) in that they follow the use of land, without the owner's consent, openly and over a continuous period of at least 20 years.The main difference is that the use of the land is shared by more than one person. If the owner of the property acts to defend his property rights at any time before the above period has expired then the prescriptive right will cease, and any attempt to re-establish it will have to begin again.

Easements by prescription may arise under the common law, under the Prescription Act 1832 or by lost modern grant.

The right of way claimed must be one that could have been granted in accordance with the law. For example a right of way claimed for the purpose of tipping rubbish unlawfully on land could not have been lawfully granted and cannot be acquired by prescription. On the other hand, a right to drive a vehicle over land that is a restricted byway without lawful authority is an offence, but as lawful authority could have been given then such a right is capable of being acquired by prescription.

It should be noted that prescriptive rights cannot be acquired over railway land or land owned by the British Waterways Board, due to the operation of the British Transport Commission Act 1949.

6 Easements by Estoppel

Easements by estoppel are created by the court to prevent an inequitable outcome where the vendor has misrepresented that he would grant an easement to the purchaser but in fact did not expressly grant the same. If the purchaser bought the property and relied in good faith on the existence of such an easement as part of his decision to buy then the court will normally make an order for the easement.

For example, the purchaser may tell the vendor that he wishes to build a garage on part of the land being sold to him and the vendor may agree that he can access the garage by using a particular drive on his land. If no easement is granted by deed to effect such a right, but the purchaser has relied on the vendor's representation in consideration of purchasing the property then he would be entitled to an easement by estoppel.

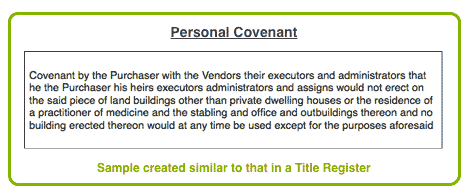

Restrictive and Personal Covenants

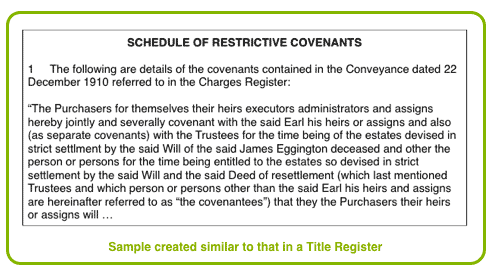

Restrictive Covenants are covenants made between a purchaser and vendor, that "run with the land" and burden a property, for example, a covenant not to develop the land or to use it for commercial purposes. Such covenants, because they run with the land, burden it even if the property is sold to someone else. Restrictive Covenants are recorded in the C section of the Title Register; if lengthy, they may appear in a Schedule at the end of the C section. Much more detail of the Covenants is usually contained in the Deed creating them.

Personal Covenants are covenants which do not run with the land, and usually relate to an action that the Purchaser has agreed to take when buying the property, e.g. erecting a stock proof fence. They do not burden the land and are only enforceable against the person making the covenant, although a new owner may be required to enter into a covenant in similar terms when buying the property. They are recorded in the A section of the Register, and again, are often detailed more thoroughly in the Deed creating it.

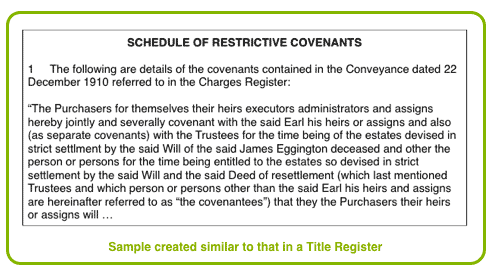

Schedules

Schedules are a convenient way of annexing long detailed lists of covenants, leases, agreements, etc that would otherwise take up a disproportionate amount of space within the body of the Register. Schedules will appear at the end of the Register. If there are many schedules they will be numbered, "First Schedule", "Second Schedule", etc, or may be identified as "Schedule of Restrictive Covenants", "Schedule of Leases" and so on.

Lost Deeds

Where a property is registered the ownership documents are never lost, as copies can be obtained at any time by applying to the Land Registry. The documents of Title are the Title Register and Title Plan and copies can be obtained from us using our Title Register search.

Losing Deeds is only a problem if the property is unregistered. In such cases the Land Registry do not usually have any records pertaining to the property, save where there is a Caution Against First Registration.

In such instances a solicitor should be instructed to re-constitute the Title, which he will do in the following way:

1 Search of the Index Map. This will confirm whether or not the property is registered and will also state if there is a Caution Against First Registration in respect of the property. If there is there will be a Caution Title in favour of the person in whose interest the Caution is registered. A Caution Title will provide details of such person. There will also be a Caution Title Plan identifying the property.

2 Apply to the Land Registry for First Registration of Title. Rule 27 of the Land Registration Rules 2003 provides that where a person is unable to produce a full documentary title, evidence must be provided with the application that he is entitled to apply under under section 3(2) Land Registration Act 2002 (because the estate is vested in him or he is entitled to have it vested in him), and to account for the absence of documentary evidence.

The Statement of Truth should include:

- Confirmation that the applicant is the legal owner of the estate

- A description of the land and enclose a plan outlining the land

- State whether it is a freehold or leasehold estate

- (If leasehold, for how many years it was granted for and from when)

- State ther period of ownerhsip

- Who had possession of the Deeds when lost or destroyed

- State why such person had had possession or custody of them

- State how they were lost or destroyed

- State what steps have been taken to recover them

- State whether or not there was a mortgage or charge over them

- Rights exercised by the applicant over the land, e.g. living there

- Annexe to the Statemet:

- Any copy Deeds

- Drafts of Deeds or

- Other documents relating to the property, such as:

- inheritance tax declarations

- Rates receipts

- fire insurance policies, etc.

- Provide evidence of Identity

3 Statements of Truth using Land Registry form ST3. Quite often there will need to be several Statements of Truth, from various witnesses, e.g. the applicant, his solicitor and a mortgagee or bank. This is where the applicant will account for the absence of documentary evidence, and where he will provide such other evidence as he may have, e.g. the Deeds may have been lost in a fire, or where they were lost having been in the custody of another, e.g. a bank or solicitor. Establishing the identify of the person in whose custody there were last in is usually an important factor to include in this Statement. The Statement should also attempt to provide a reconstruction of the Title from the available evidence.

The Land Registry will usually only grant a Possessory Title where there is still some doubt as to ownership.